How to Become a Filer in Pakistan – The Guide for Businesses

How to Become a Filer in Pakistan? – The shocking and unfortunate truth is that only 1% of Pakistanis are active tax payers and if you’ve ever wondered why the government has to rely on IMF to run its day-to-day business, here it is. As the fifth largest country in the world, Pakistan demands more from its local manufacturers. This gap is met by my grants, aids and loans. If only all those who are eligible to pay taxes do the bidding, the government of Pakistan will not have to seek money from outside sources.

If you run a business and want to become a tax filer, this comprehensive article is for you. Here you can find step-by-step information on how to become a taxpayer in Pakistan. However, if you want to file taxes as an individual, read the details below as well:

Steps to Become a Filer in Pakistan (Businesses)

Mentioned below are the complete steps to become filer online thru FBR online portal.

Step 1: Filer Registration / Register or Enroll with FBR (IRIS)

Individuals, companies or associations of persons (AOP) are considered registered when registering electronically on the Iris portal. After registration, you will receive a National Tax Number (NTN).

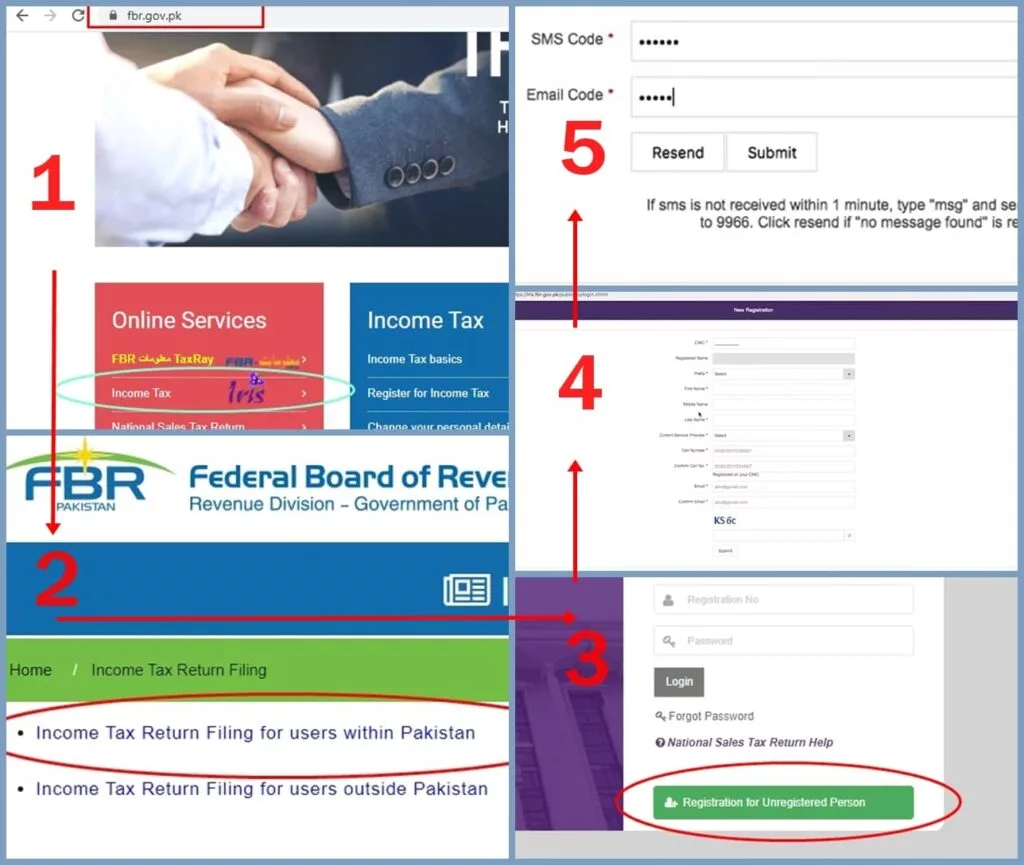

First visit FBR website https://www.fbr.gov.pk.

- Start with Online Services and click on the income Tax or IRIS.

- Next you will have to choose from 2 options.

- Income Tax Return Filing users within Pakistan

- Income Tax Return Filing users outside Pakistan

- Now, you can click on the button “ Registration for Unregistered Person”.

- Fill all the necessary information and click submit.

- You will receive verification codes on the submitted mobile number (via SMS) and email address. Enter both verification codes in the required sections.

- Now, your initial registration is completed and you will receive your NTN & password via email and SMS.

Before we go further in registration, the Principal officer of the company or AOP needs to gather the following information.

- Name of the AOP or Company

- Name of the Business

- Complete Address of the business

- Accounting Period

- Valid Phone number of the business

- Valid E-mail address

- Mobile phone number of principal officer of the company or AOP

- Principal business activity

- Address of industrial establishment or principal place of business

- Type of Company i.e. public limited, private limited, unit trust, trust, NGO, society, small company, modaraba or any other

- Registration Date

- Incorporation certificate by Securities and Exchange Commission of Pakistan (SECP) in case of company

- Registration certificate and partnership deed in case of registered firm

- Partnership deed in case firm is not registered

- Trust deed in case of trust

- Registration certificate in case of society

- Name of representative with his CNIC or NTN

- Following particulars of every director and major shareholder having 10% or more shares in case of company or partners in case of an AOP, namely:-

- Name

- CNIC/NTN/Passport and

- Share %

Note – This is for account registration with FBR only. For the next step you need to visit any suitable counter. Online registration is only available to individuals.

Step 2: Get NTN / Complete Registration to Be a Filer in Pakistan

Mentioned below are the documents required to register AOP with FBR.

For registration of an AOP, anyone of the members / partners must personally visit any Facilitation Counter of any Tax House with following documents:

- In case of Firm, Original partnership deed.

- In case of Firm, Original registration certificate from Registrar of Firms,.

- CNICs of all Members / Partners.

- Original letter on letterhead of the AOP signed by all Members / Partners, authorizing anyone of the Members / Partners for Income / Sales Tax Registration.

- Cell phones with SIM registered against their own CNIC but not already registered with the FBR.

- Email address that belongs to the AOP.

- Original certificate of maintenance of bank account in AOP’s name.

- Original evidence of tenancy / ownership of business premises, if having a business.

- Original paid utility bill of business premises not older than 3 months, if having a business.

For registration of a company, the principal officer must personally visit any Facilitation Counter of any Tax House with following documents:

- Company’s Incorporation Certificate.

- CNICs of all Directors.

- An Original letter (on letterhead of the company) signed by all the Directors that verifies the Principal Officer and authorizes him / her for Income Tax / Sales Tax Registration.

- Cell phone with SIM registered against his / her own CNIC. It should not already be registered with the FBR.

- Company’s email address.

- Original certificate of maintenance of bank account in Company’s name.

- Original evidence of tenancy / ownership of business premises, if having a business.

- Original paid utility bill of business premises not older than 3 months, if having a business.

Step 3: File Income Tax Returns to Become Tax Filer in Pakistan

Once you complete with above 2 steps, you need to login https://iris.fbr.gov.pk/public/txplogin.xhtml. with the credentials (CNIC/NTN and password). Mentioned below is the complete process to file income tax returns.

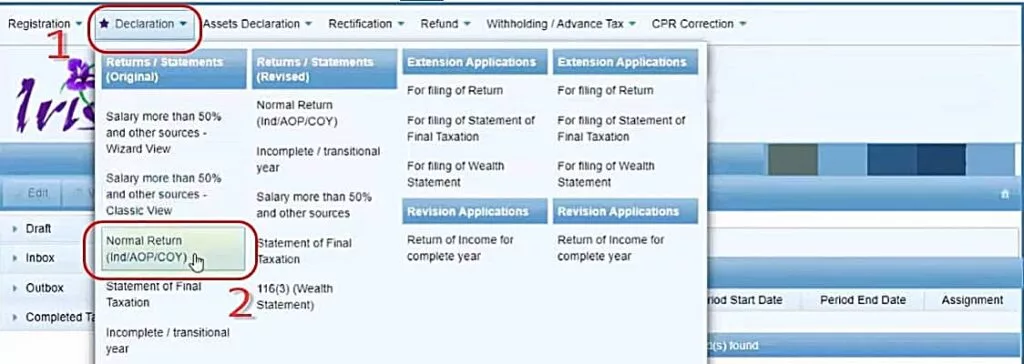

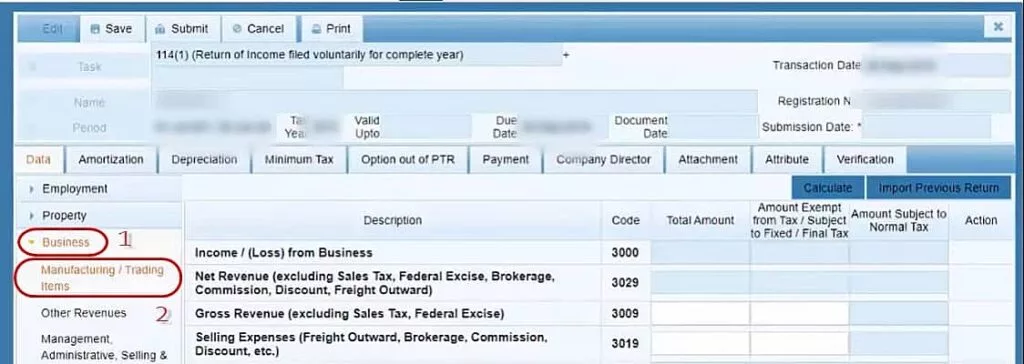

1 – Click on the declaration tab and then normal returns. New window will open.

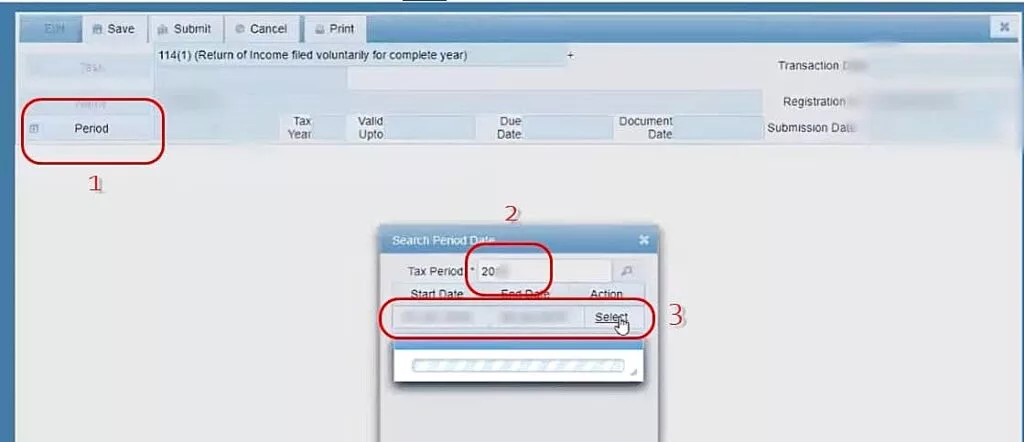

2 – Now, click on the period and select the year you want to file the returns.

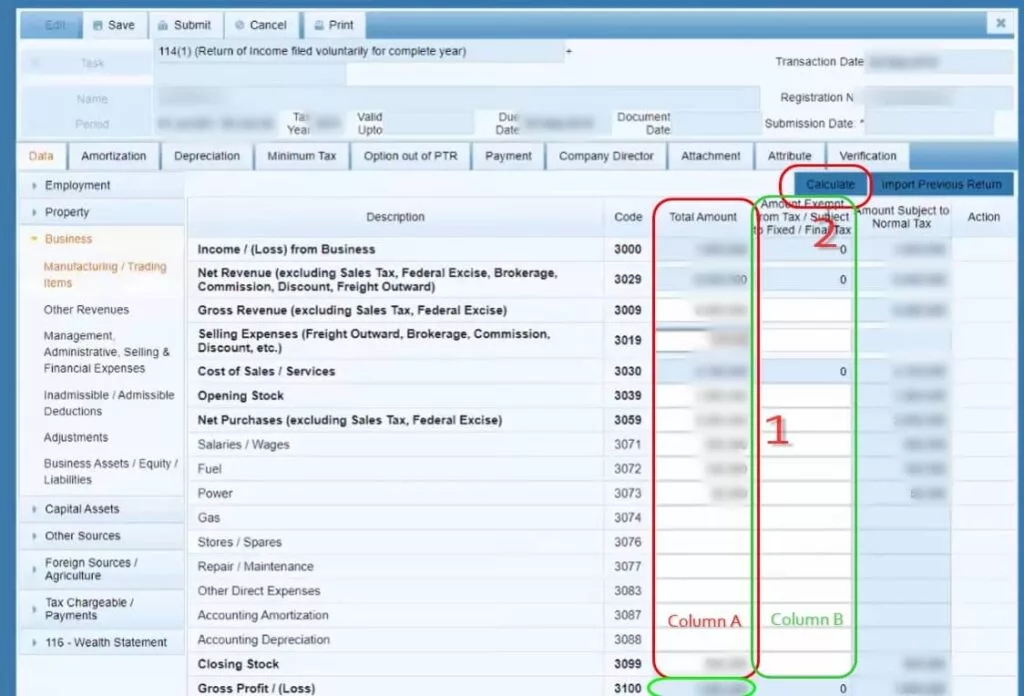

3 – Click the “Business” tab and then the “Manufacturing and Trading” tab.

4 – Fill in all the amounts in the relevant cells of “Column A” like Cost of Sales, Opening stock, Net Purchasing, Salaries, etc. Add the amount exempted from tax in the designated cell of “Column B”. Then click calculate.

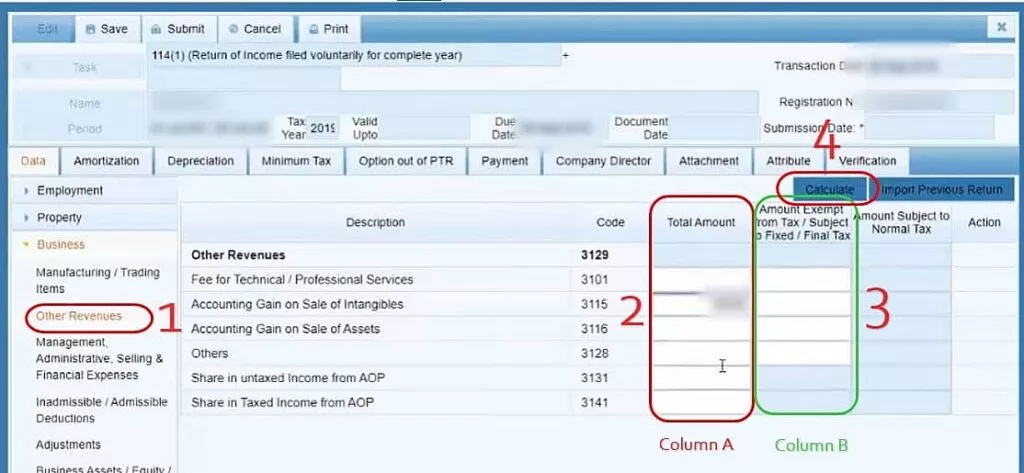

5 – Now, click the “Other Revenue” tab and add all the revenues from other sources in relevant cells of “Column A”. Add revenues exempted from the taxes in “Column B”. Then, click calculate.

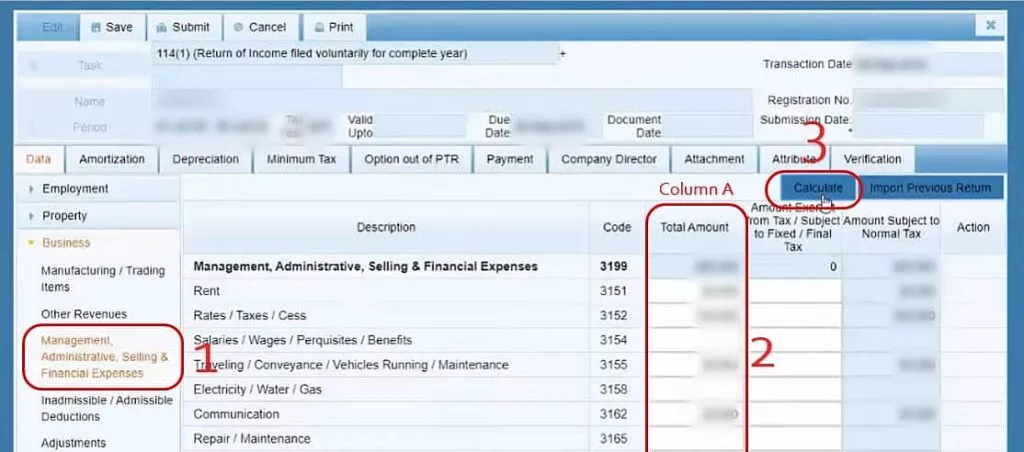

6 – Click the “Management & Administrative Expenses” tab. Fill in all the amounts of expenses in the relevant cells of “Column A”. Then click calculate.

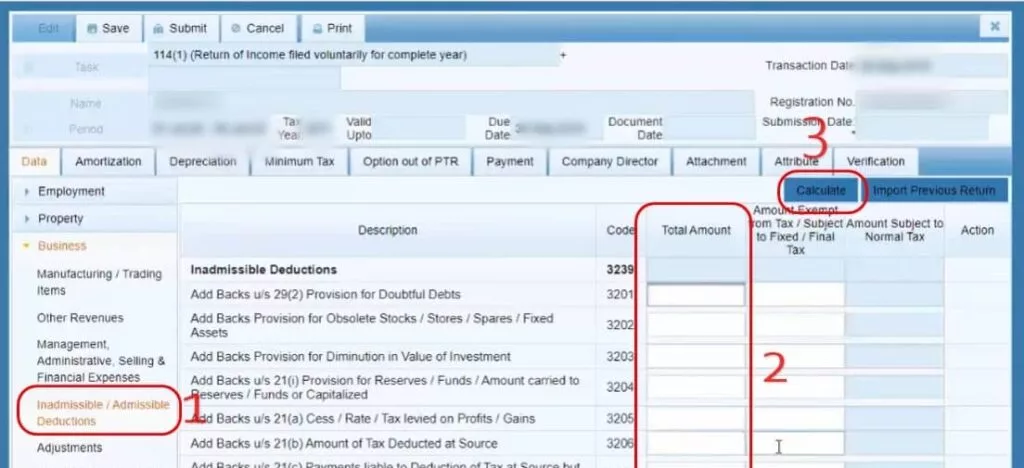

7 – Click the “Inadmissible and Admissible” tab and fill in all the required information. Then click calculate.

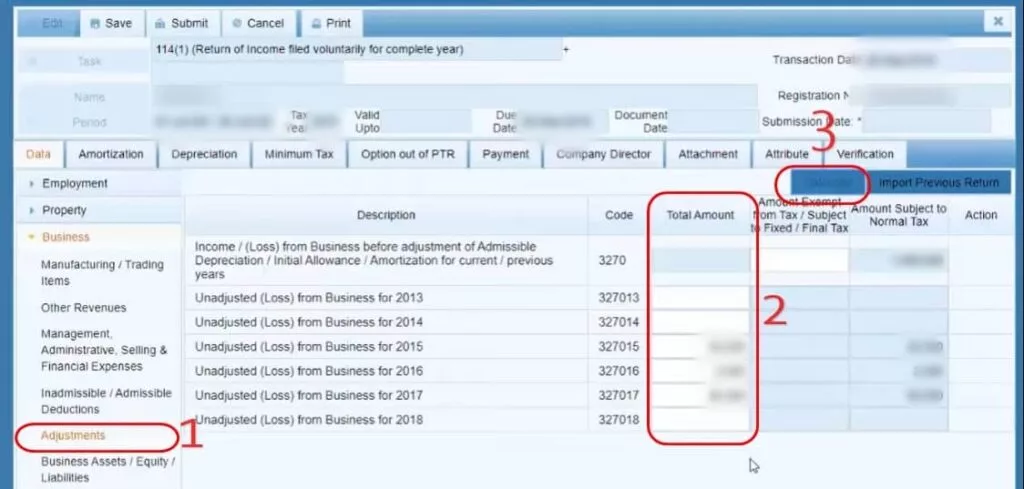

8 – Click the “Adjustments” tab. Here you can add losses of up to the previous 6 years. Only 6 years of losses can be carried forward. But you need to learn about the laws and other details in this regard. After adding, click calculate.

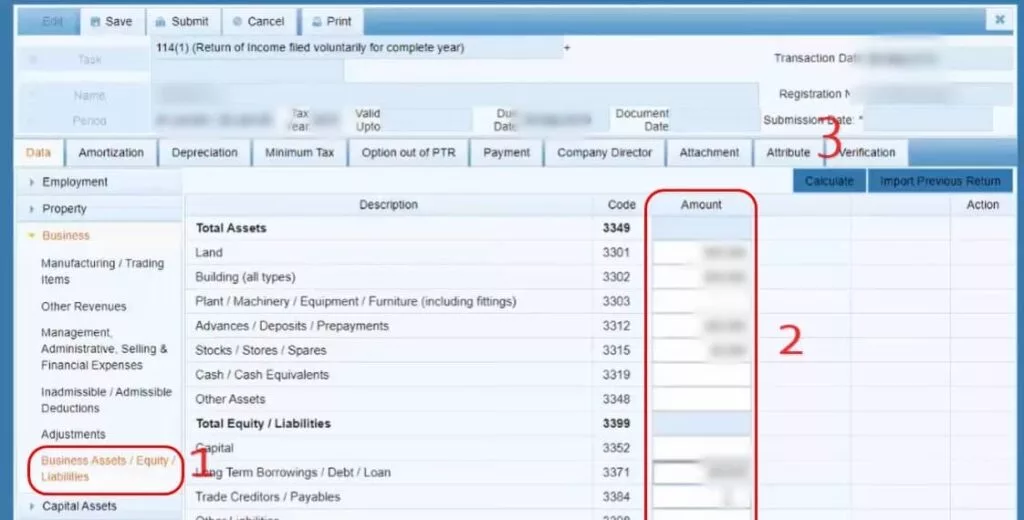

9 – Click the “Business Assets / Equity / Liabilities” tab. Add all the assets, equities, and liabilities in the relevant cells. Click calculate at the end.

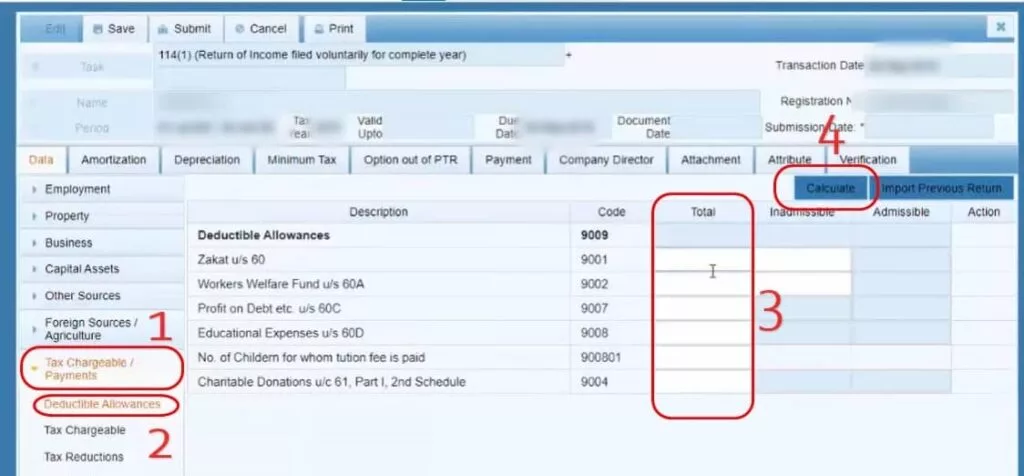

10 – Click the “Tax Chargeable” tab and then click the “Deductible Allowance” tab under it. Add all the deductible allowances in the relevant cells and then click calculate.

- Click the “Tax Reduction” tab and enter the reduction amount (if any). Click calculate.

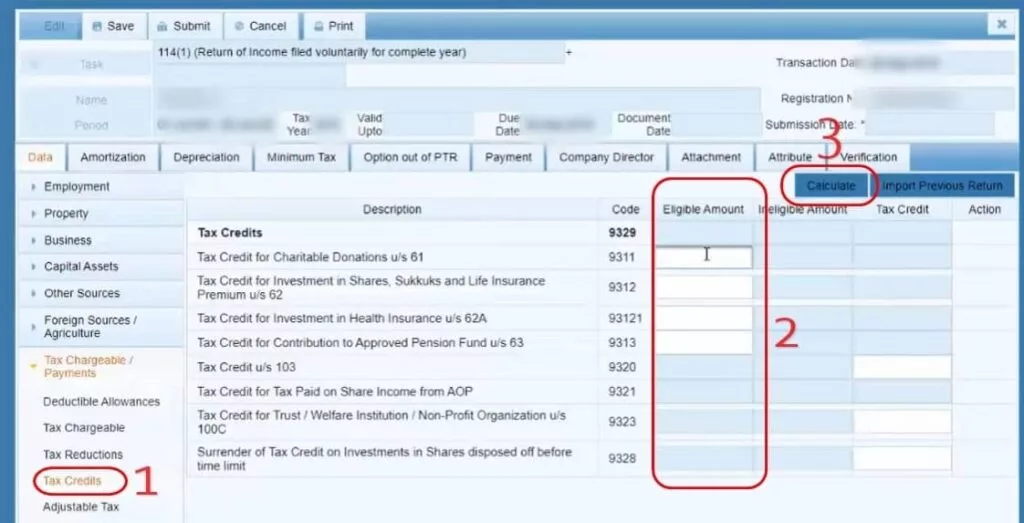

- Click the “Tax Credit” tab and fill in all the details (if any). By clicking calculate, you will see the tax amount to be credited. *

- Tax Credit is offered to promote different types of investments in welfare projects and others.

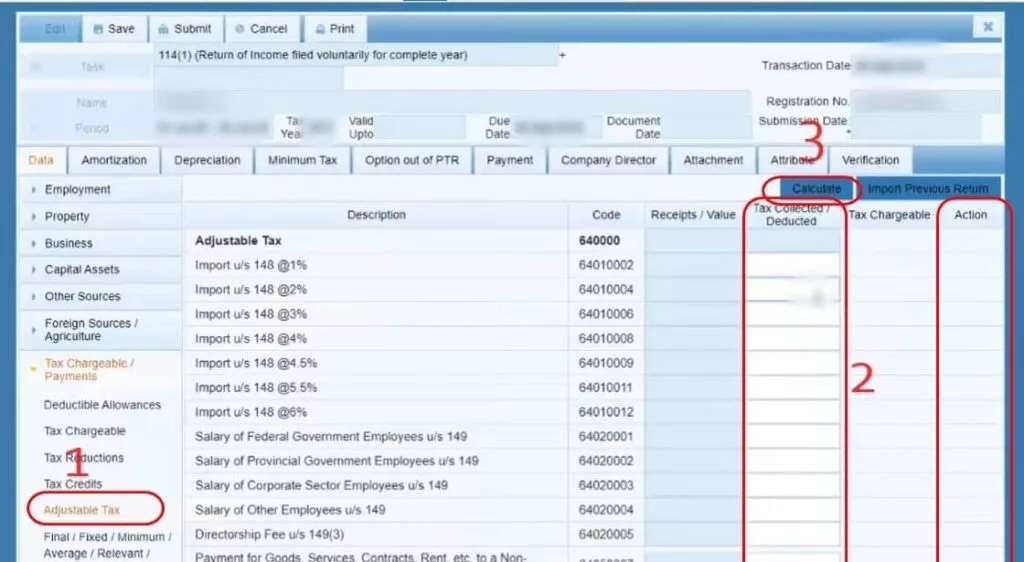

11 – Click the “Adjustable Tax” tab and add all the adjustable taxes you have already paid. Click calculate after that.

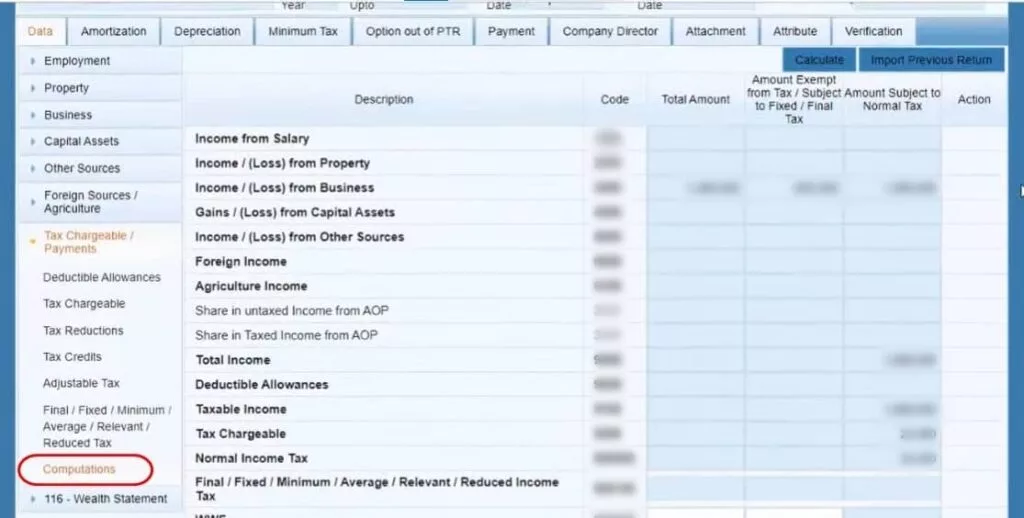

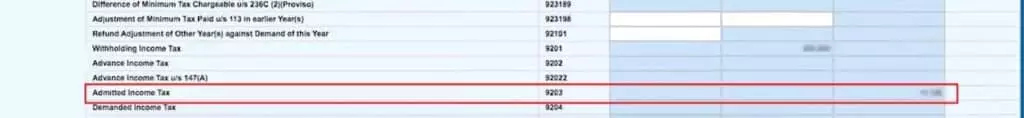

12 – At the end, you need to click the “Computations” tab and see all the details already calculated there. Below, you will find a row of “Admitted Tax”. It is the Tax to be paid by your side.

How to Pay Tax to Become a Filer in Pakistan?

In case you have any amount in the admitted tax section, you will not be able to file returns till tax submission. Mentioned below are the steps to pay your tax to file returns.

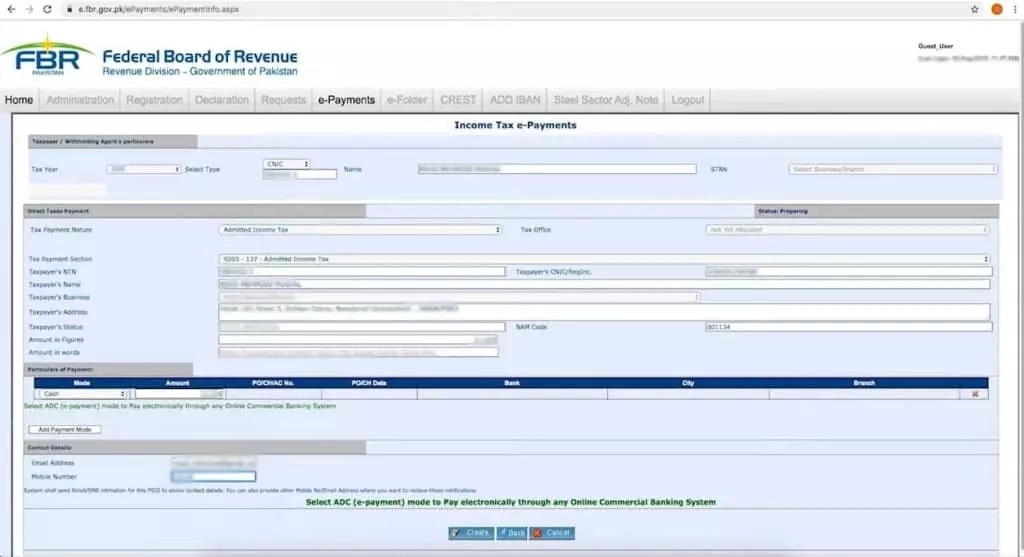

- Visit this page https://e.fbr.gov.pk/ePayments/ePaymentInfo.aspx.

- Select tax year.

- Enter CNIC/NTN.

- Your name will automatically be picked up by the system.

- Select Admitted Tax in the Tax Payment Nature tab.

- System will pick details automatically.

- Select Admitted Tax in the Tax Payment section.

- Enter the amount of Admitted Tax in the Amount in Figures section. *Pick the amount from the Return Form.

- It will automatically convert figures into words.

- Now select the desired payment mode. We’ll take Cash payment mode as an example.

- Re-enter the amount.

- Enter email address and mobile number.

- Click the Create button, and the system will show you a check message. Check the details carefully and click the Confirm button.

- You will get the option to print Challan.

- Print it and pay it in the National Bank (any branch).

- You will be given a computerized payment receipt number by the bank.

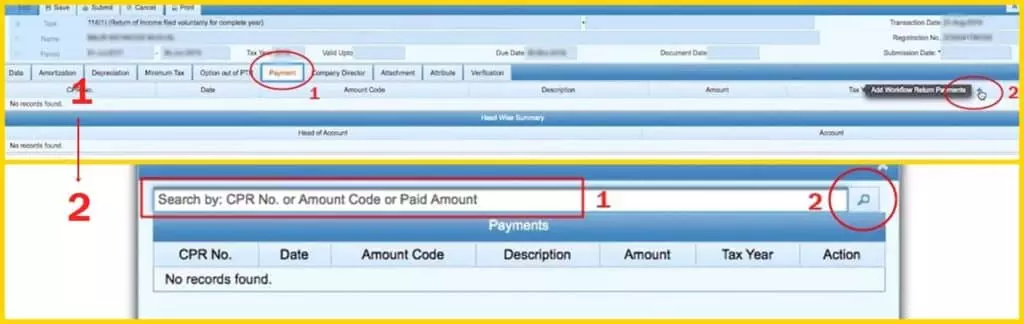

- Go to the payment section in FBR-IRIS to enter payment details.

- Click on + button.

- Enter the computerized payment receipt number and click the search button.

- You will see your payment record. Select it and it will be added.

Step 4: File Wealth Statement to Be a Filer in Pakistan

Now is the time to add details about your assets. Here are the steps for the asset declaration.

- Login (if you logged out after the previous step) to FBR-IRIS, click on the draft, then click on declaration, after that click on the form and then click edit button.

- Add all the assets, liabilities, and capital you have till 30-June of the selected year.

- You also need to add the sum of all assets of the previous year.

- Click the calculate button. The Unreconciled Amount must be zero to file the returns. Check all the details before submitting as details cannot be changed after submission.

- After review, click on the verification tab and enter the 4 digit pin you received at the time of registration. Click on the Verify Pin button then.

- Now, Click on the Submit button.

- Congratulations! You have filed tax returns now.

This guide has most of the information for you to become a filer in Pakistan if you are a business. If you still find it hard to do it yourself, you can get professional services to become a filer in Pakistan.

Also Read: How to Apply for CNIC in Pakistan? Step by Step Guide