SRO Arrived: 25% GST On Cars Pricing Above Rs. 40 Lacs

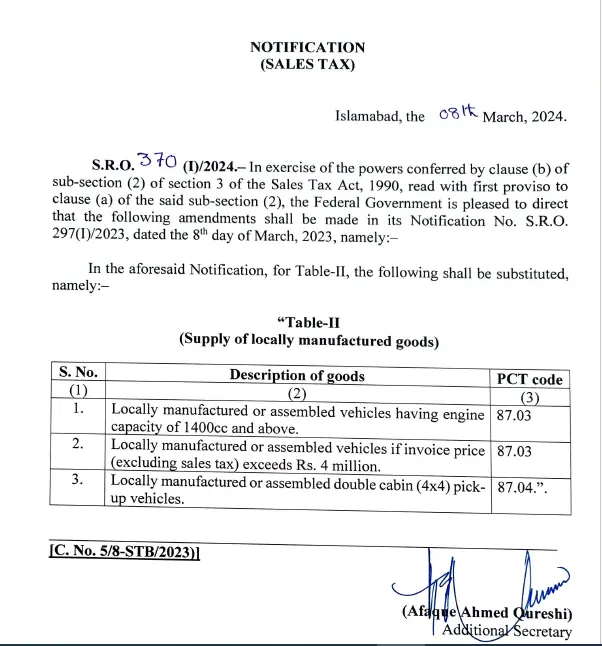

It has been confirmed that the government has introduced 25% GST on cars priced above Rs. 40 lakh. In a new SRO 370 (I)/2024, Ministry of Finance and Revenue stated that it is pleased to order the amendments in its notification No. SRO 297(I) 2023, dated March 8, 2023.

According to the new amendment, 25% GST on cars will be implemented on:

- Locally manufactured or assembled vehicles having an engine capacity of 1400 cc and above.

- Locally manufactured or assembled vehicles if the invoice price (excluding sales tax) exceeds Rs. 4 million.

- Locally manufactured or assembled double cabin (4x) pick-up vehicles.

It is important to note that 25% GST is already applicable for cars with an engine capacity of 1400c and above. The second point of SRO is also important; that is, all cars over Rs. 40 lakh will now have 25% sales tax, but there is another point.

The second clause says “excluding sales tax,” meaning the price of the car does not include sales tax. Explaining the matter, a Suzuki official said that some variants of the Suzuki Cultus and Swift cost more than Rs. 4 million, but excluding sales tax, this new tax net only includes the Swift GLX. It’s funny, isn’t it? However, the picture will become clearer in the coming days as the company announces the revised prices for this new SRO. So wait and watch.

Other cars or variants that may come under this new GST network are the Honda City, Toyota Yaris, and Proton Saga, but we have to wait for an announcement from these companies.

Also check: KIA Sportage Price in Pakistan Slashed Now by 3 Lacs!