Revised Motor Vehicle Taxes: Increased Up to Highest 233%

In a recent development, the Punjab government in Pakistan has implemented a revised Motor Vehicle Taxes as part of the budget for 2023-24. These changes include increased registration and transfer fees, as well as higher withholding taxes.

You must be wondering how much tax has been raised on cars, bikes, rickshaws and other motor vehicles, right? Let’s see the new rates here.

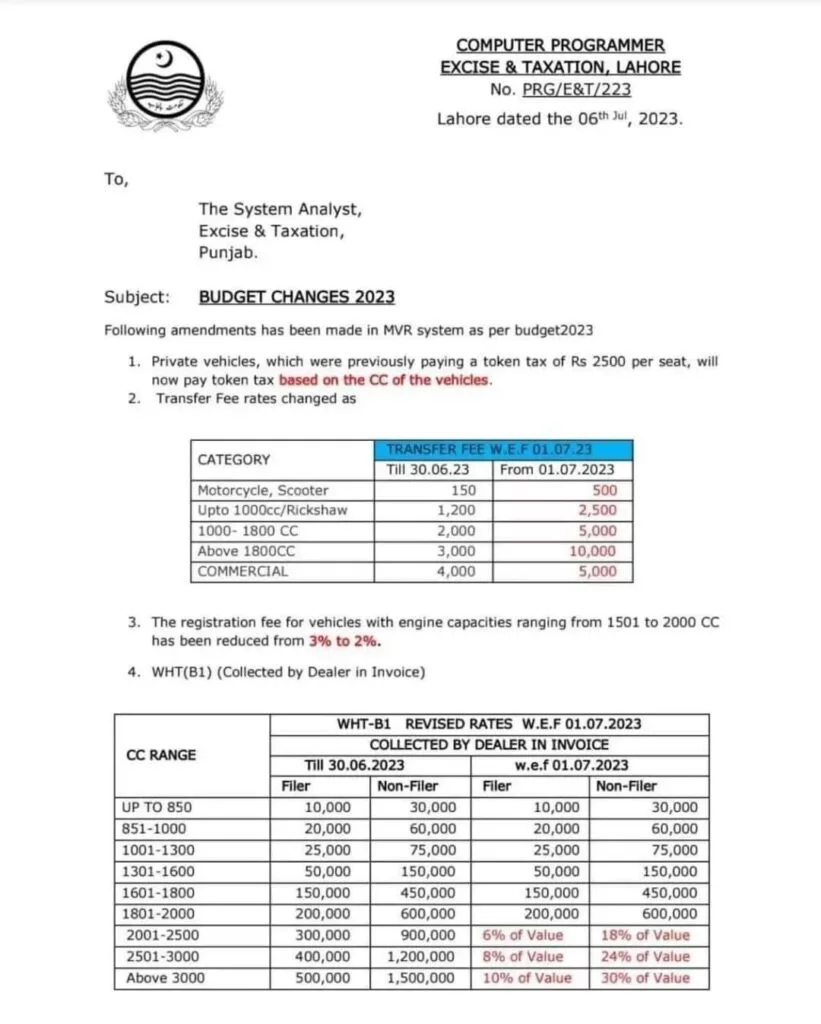

Revised Transfer Fee on Motorcycles, Cars, & Others

The revised transfer fees for motorcycles, cars and commercial vehicles are as follows:

| Category | Old Fee (Rs.) | New Fee (Rs.) | Difference (Rs.) | Difference (%) |

| Motorcycle / Scooter | 150 | 500 | 350 | +233% |

| Up to 1000cc / Rickshaw | 1,200 | 2,500 | 1,300 | +108% |

| 1000- 1800 CC | 2,000 | 5,000 | 3,000 | +150% |

| Above 1800CC | 3,000 | 10,000 | 7,000 | +233% |

| COMMERCIAL | 4,000 | 5,000 | 1,000 | +25% |

New Withholding Tax Rates

The revised Withholding Tax Rates for motorcycles, cars and commercial vehicles are as follows:

| Engine Capacities | Old Rates (Filer) | Old Rates (Non-Filer) | New Rates (Filer) | New Rates (Filer) |

| Up to 850 | 10,000 | 30,000 | 10,000 | 30,000 |

| 851-1000 | 20,000 | 60,000 | 20,000 | 60,000 |

| 1001-1300 | 25,000 | 75,000 | 25,000 | 75,000 |

| 1301-1600 | 50,000 | 150,000 | 50,000 | 150,000 |

| 1601-1800 | 150,000 | 450,000 | 150,000 | 450,000 |

| 1801-2000 | 200,000 | 600,000 | 200,000 | 600,000 |

| 2001-2500 | 300,000 | 900,000 | 6% of Value | 18% of Value |

| 2501-3000 | 400,000 | 1,200,000 | 8% of Value | 24% of Value |

| Above 3000 | 500,000 | 1,500,000 | 10% of Value | 30% of Value |

Other Changes

Here are some other tax changes in this letter.

- Personal vehicles were previously taxed at 2500 per seat, will now be taxed based on the CC of the vehicle.

- The registration fee for vehicles with engine capacity between 1501cc and 2000cc has been revised down from the previous 3% to 2%.

Note: The new rates are effective in Punjab from July 1, 2023.

Also Read: 10 Lazy Ways To Make Money Online While You Sleep

Analysis

The revised tax rate mainly targets the elite class with higher tax levied on vehicles above 2000cc engine. Non-filers face significantly higher tax rates than filers in order to encourage greater tax compliance.

The increase in transfer fees (up to 233%) was an unexpected surprise. In motorcycles, rickshaws, cars, etc. These surcharges not only affect the rich but also put an additional burden on middle and low income people who are exposed to inflation.

Discounted registration fees for vehicles with engine capacity between 1501cc and 2000cc, KIA Sportage, Hyundai Tucson etc. provide relief to certain vehicle customers.

The IMF agreement is the main reason for this tax change. It remains to be seen how people will react to these changes and whether the government will implement them once their tax targets are met.

Is it fair to increase premiums for people exposed to inflation related to IMF contracts? Share your thoughts in the comments section below.

Also Read: How To Pay Car Token Tax Online All Over Pakistan